Background

- A bank was finding it difficult to approve higher loan amounts through automated decision channel, thereby losing share to its competitors

- They were looking to align with Community Reinvestment Act (CRA) guidelines and improve standing amongst marginalized businesses

Solution

- Uplinq’s expert modeling techniques combined powerful external data variables, in combination with client data, to create a high performing score and assessment thereby allowing the bank to approve many more loans and assign appropriate limits to close deals

- Uplinq’s model significantly improved CRA coverage and approval rates, thereby providing strong impetus for growth in this segment

Results

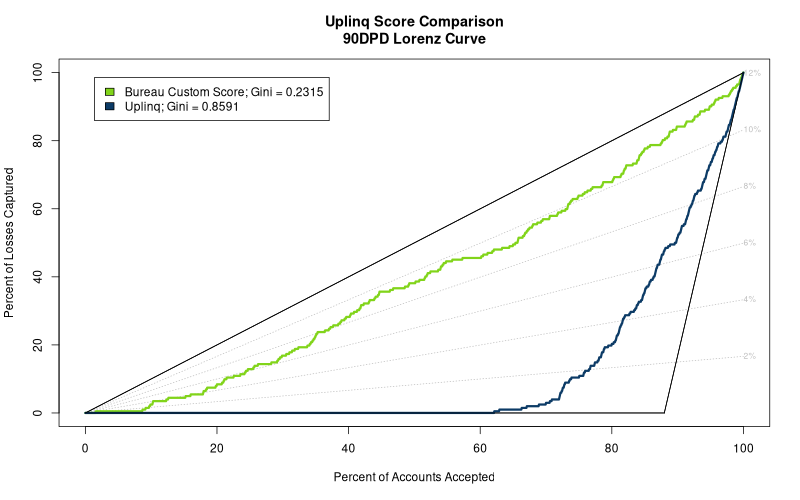

- Uplinq’s model performed 2.6x better than the existing bank model

- Bank able to approve between 62% and 78% of declined accounts

- Reduced NPL rates between 75% and 83%, despite increased book size

- Uplinq projected an expected $78 million profit for the bank over the next 5 years for just one business line

- Bank will achieve an overall $220 million combined profit across multiple business lines