Background

•A large business bank with development roots had a mandate to facilitate additional working capital for entrepreneurs, while mitigating any increase in loss rates.

•Bank was not able to achieve expected results despite internal risk model experimentation. Improvements came at the behest of tightening credit, which was against their business strategy.

Solution

•Uplinq focused on increasing approval rates as well improving take rates

•Uplinq’s modeling methodology incorporated business context and ecosystem information, thereby building a solution that allowed for ongoing and dynamic credit risk assessment tied to regional and local economic impacts

Results

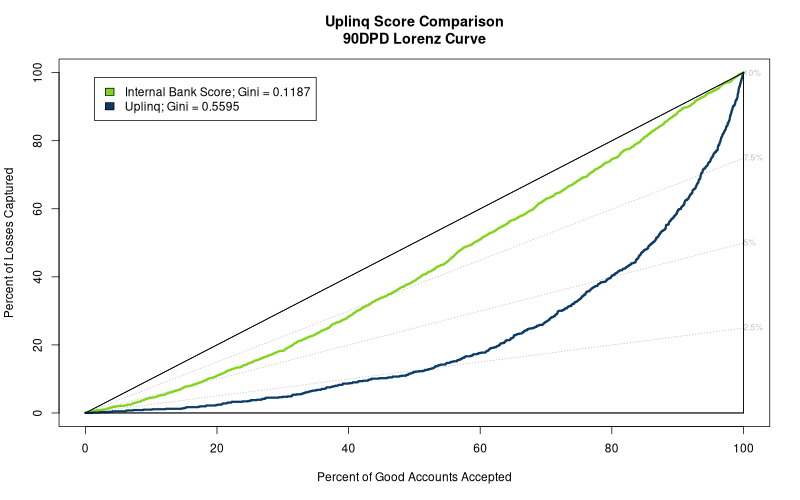

•Uplinq’s model performed 2x better than the internal business risk score

•Cut bad account rates by 50%, at the same approval rates

•Increased booking rates by 15%

•Net Credit Margin improvement of approximately $86 million/year