Background

- Create and augment a credit scoring model for fast-growing US Fintech serving SMB lenders

Results

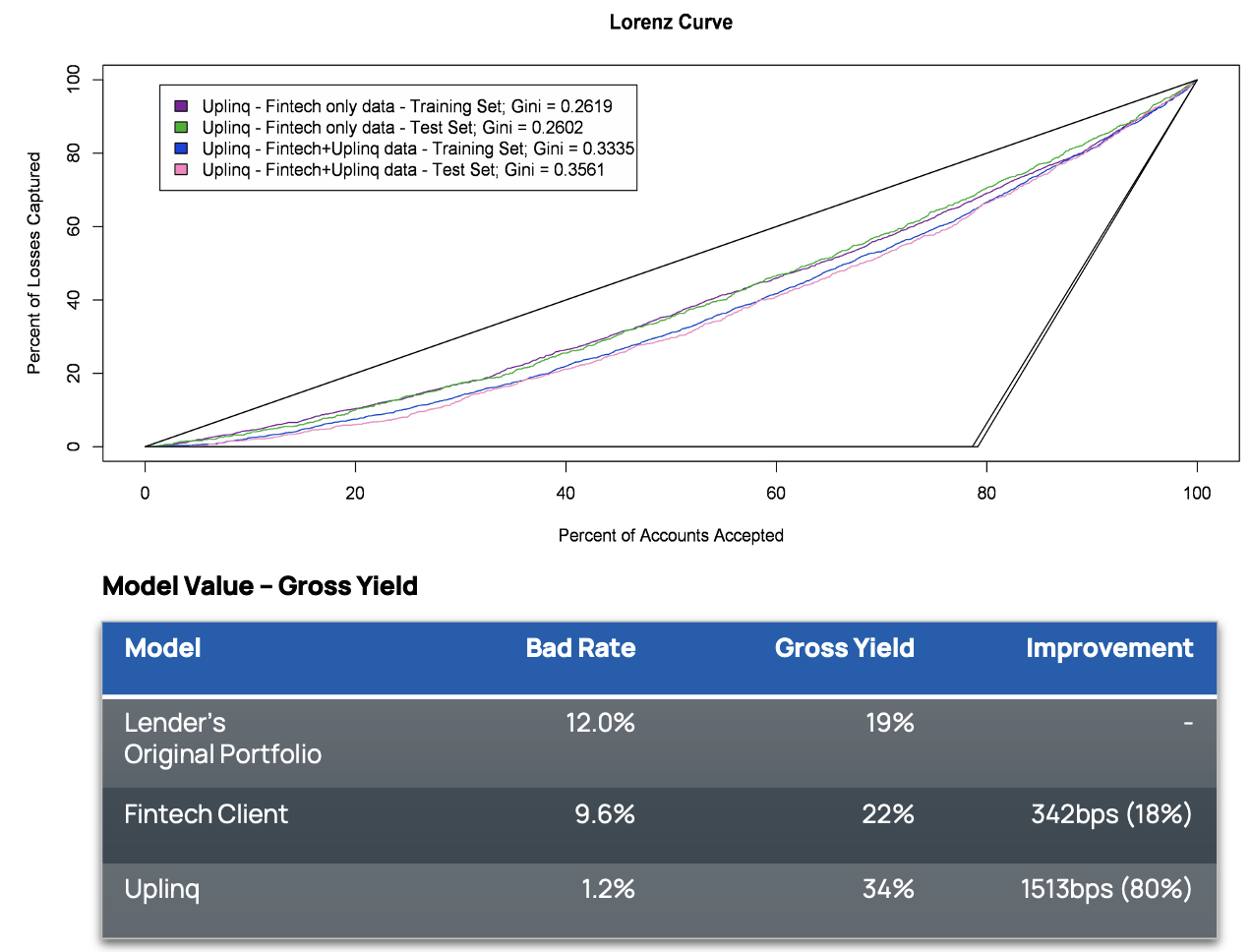

- Uplinq’s modeling and data provided robust Gini scores, despite very limited data from the Fintech across training & test data sets

- Uplinq’s time and location matched data enhanced predictability (ex. US, State, Local Economy, Gas, Labor, cost of goods, etc.)

- Uplinq model represented an 80% gross yield improvement of 1513 bps, vis-à-vis one of the lender’s original portfolio yield

Conclusion

- Uplinq’s process-oriented modeling removes vulnerability resulting from limited information, thereby producing stable & reliable underwriting models from inception

- With over $1.4 Trillion underwritten across business types, lenders and geographies, Uplinq understands the predictive attributes of small business better than most others