Background

- A bank was struggling with archaic and narrow models resulting in a tight credit box, severely limiting their ability to lend beyond a smaller segment of business customers

- Applications through their automated digital channel had relatively low approvals and funding rates

Solution

- Uplinq’s proprietary modeling technology incorporated data variables previously unknown and not considered, leading to significantly higher model performance, thereby broadening the bank’s reach into new customer segments

Results

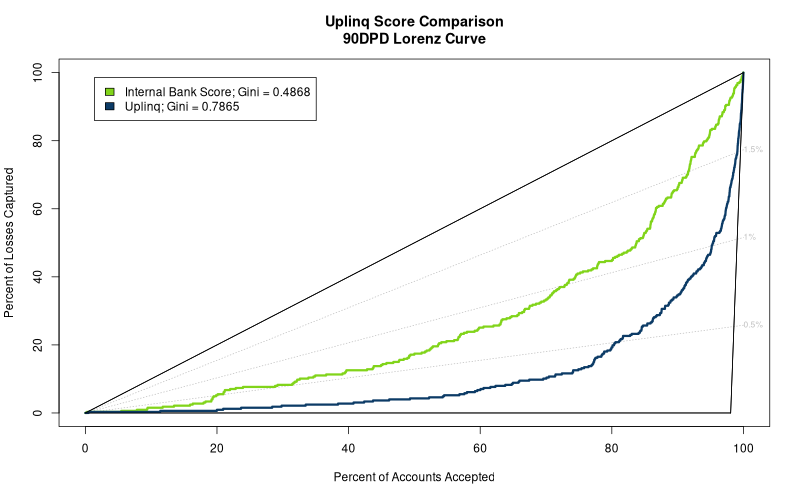

- Uplinq’s model performed 4x better than the existing bank model

- Approved 50%+ previously declined accounts

- Reduced 90 DPD rate by 84%

- Uplinq’s score increased approval rates to 75%, with effective limit assignment to improve speed and cost of underwriting via the digital channel

- Uplinq proved an ROI of 1000%+ with an additional $50 million net credit margin annually for the bank