Billions of Data Series Providing a Deep Understanding of the Business’ Environment

Understanding Business Context Matters

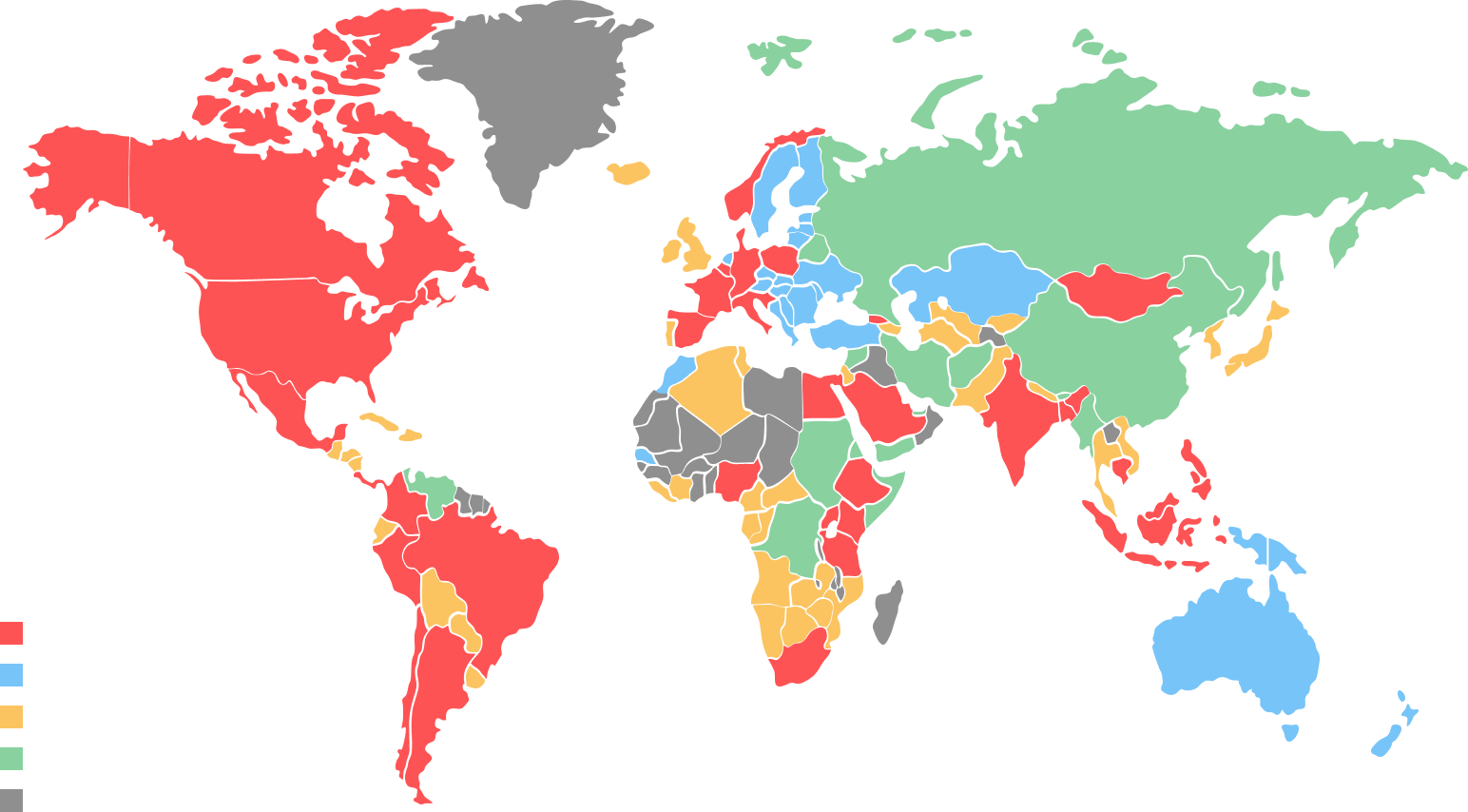

Uplinq has connectivity to 10,000+ highly reliable and validated unique data sources in 150+ countries. Traditional, alternative, contextual, market data including macroeconomic, microeconomic, regional all the way up to street level information.

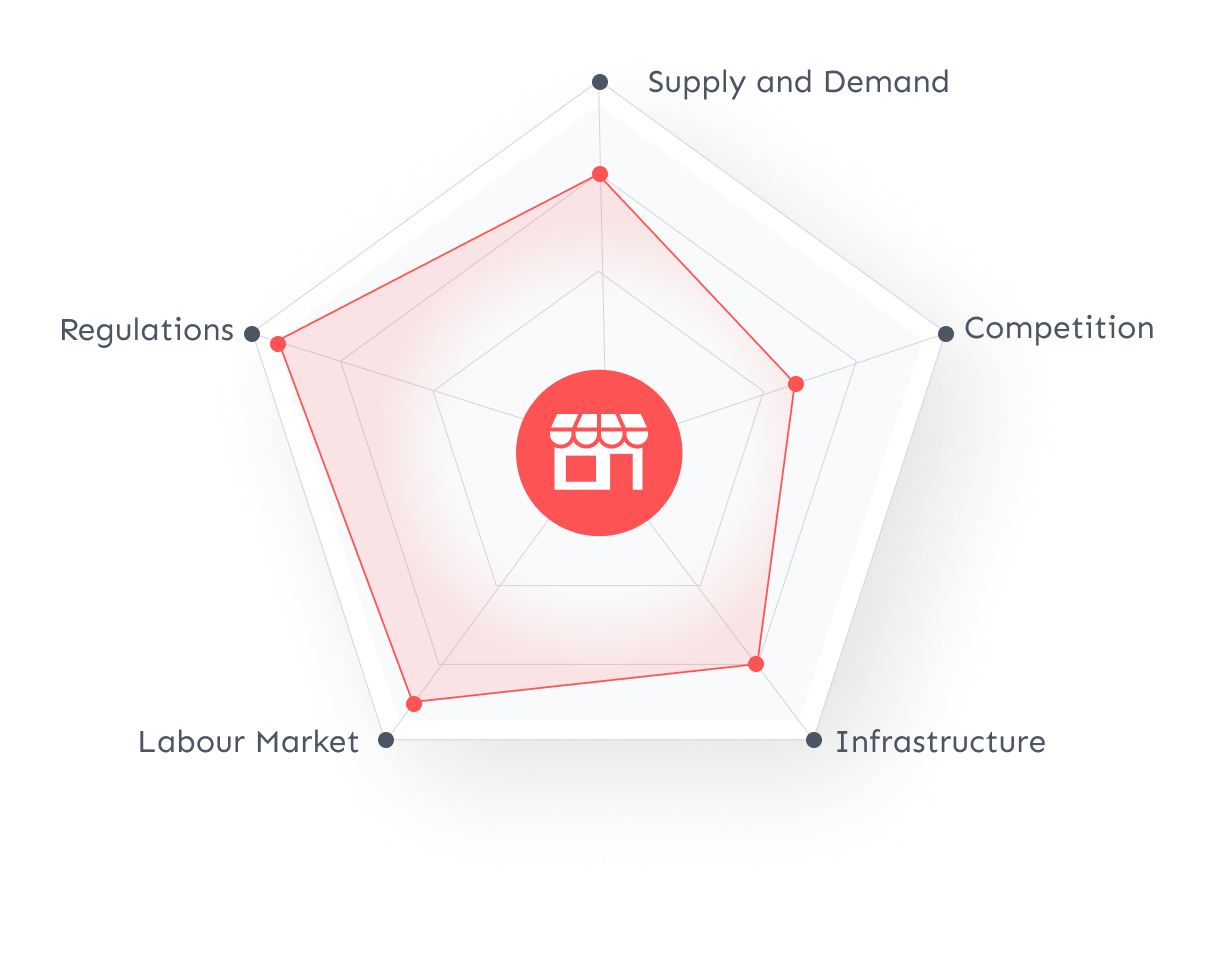

Information that helps understand supply and demand factors, competitive forces, infrastructure and changing economic environments for an individual business to predict its income and growth potential.

We don’t like to call ourselves data aggregators. For us, data is a means to build highly confident and powerful risk scoring technology and assessment models for small business lenders (banks and non-banks).

Information that helps understand supply and demand factors, competitive forces, infrastructure and changing economic environments for an individual business to predict its income and growth potential.

We don’t like to call ourselves data aggregators. For us, data is a means to build highly confident and powerful risk scoring technology and assessment models for small business lenders (banks and non-banks).

Uplinq combines advanced analytics & AI techniques with both existing & alternative data sets to produce scientifically accurate credit scoring. Any small business lender that wants to reduce their risk & increase profitability should consider this solution.

Daniel Moore

Former Global Chief Risk Officer, Scotiabank

Daniel Moore

Leveraging Data with Regulatory Compliance

The biggest challenge faced by lenders in lending to small businesses is information asymmetry. Traditional sources like credit bureaus are helpful but may not be available or supply enough information. Business financials are usually self-reported and cannot be relied upon solely.

Given all these challenges, lenders assume the risk to be high, and therefore are more likely to decline the loan application. Uplinq has solved this challenge in a regulatory compliant way.

Given all these challenges, lenders assume the risk to be high, and therefore are more likely to decline the loan application. Uplinq has solved this challenge in a regulatory compliant way.