Small Business Credit Risk Assessment, Reimagined

Credit risk scoring and assessment technology for origination, portfolio monitoring and targeting.

Uplinq provides powerful, highly predictive scores and analytics via API in real-time, as part of a lender’s existing workflow. No need to replace anything.

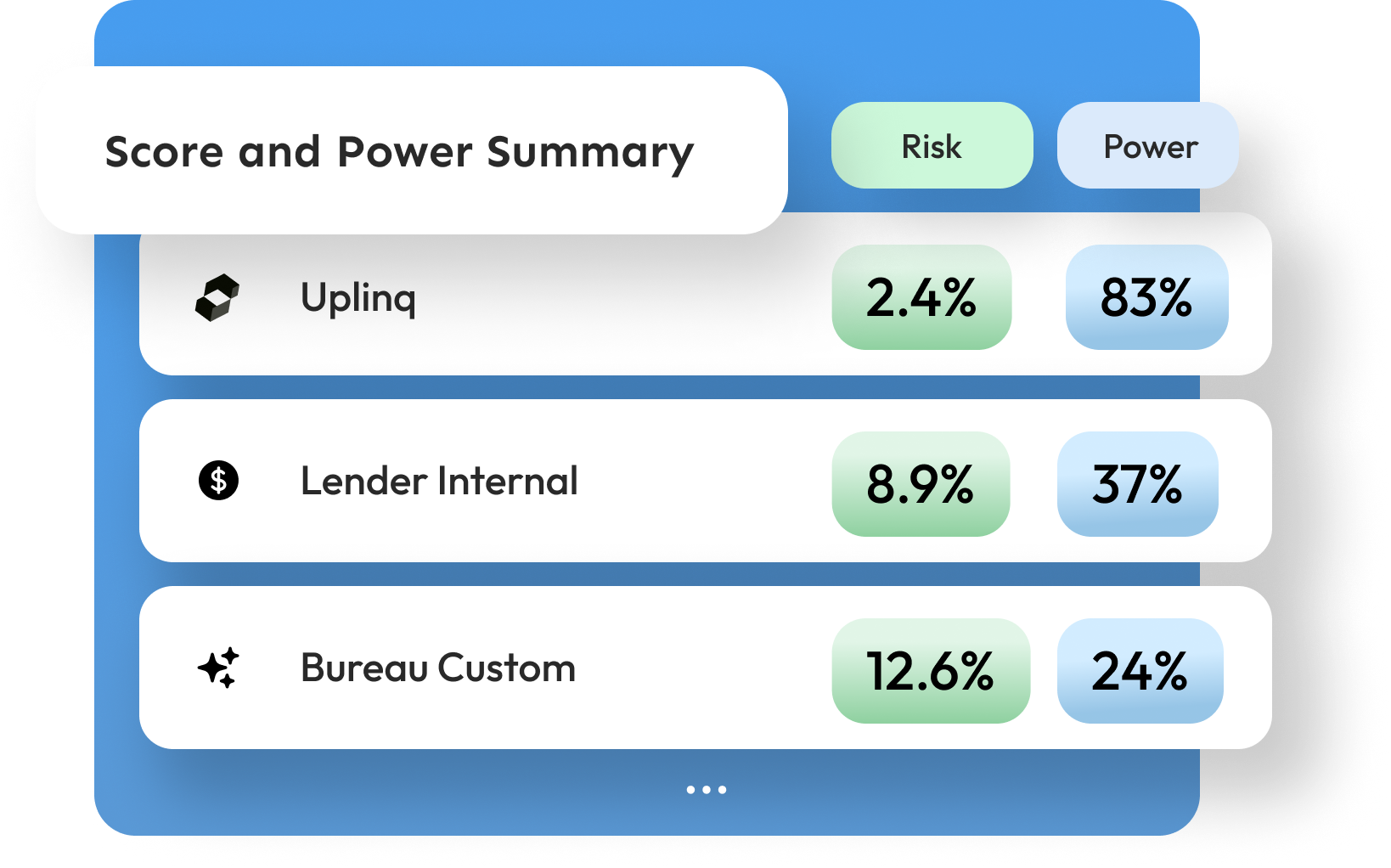

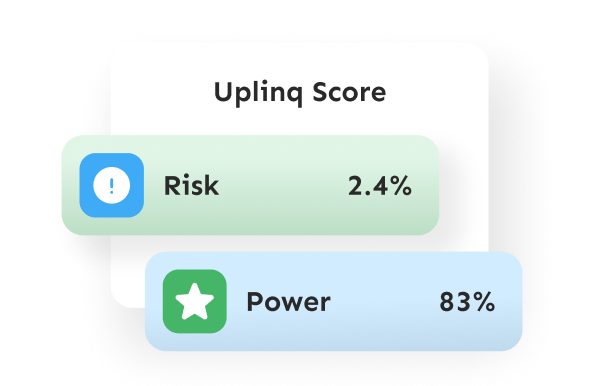

Risk & Power Score

The Uplinq risk score is a probability of default (PD) score. Furthermore, we also provide a power score. Uplinq’s power score is a confidence measure that helps a lender understand the variability in credit risk. In statistical terms, it is the Gini/KS value.

Uplinq’s scores hold their ground in information scarce environments and population segments, not just data rich urban areas. Whether it’s protected or unprotected classes, unsecured or secured loans, agricultural or trade guarantees, Uplinq’s scoring methodology helps lenders price effectively and exceed ROA targets.

Uplinq’s scores hold their ground in information scarce environments and population segments, not just data rich urban areas. Whether it’s protected or unprotected classes, unsecured or secured loans, agricultural or trade guarantees, Uplinq’s scoring methodology helps lenders price effectively and exceed ROA targets.

Uplinq uses AI-assisted expert generated models to predict

-

Probability of default

-

Probability of early repayment

-

Other factors such as bankruptcy, payment consistency, recovery, and macroeconomic impact

-

Timing of default

-

Timing of early repayment

Score Benchmarking and Compliance

Uplinq is a lender centric tool. Our team of experienced past bankers understand the regulations that banks have to comply with. To that effect, Uplinq provides scores and scorecard benchmarking as part of its native design.

Pre-Screen & Fitment

Before lenders embark on underwriting, there are many other regulatory requirements and product guidelines that need to be met.

Regulation is part of the product design rather than an afterthought.

Uplinq helps lenders pre-screen against any criteria such as:

Regulation is part of the product design rather than an afterthought.

Uplinq helps lenders pre-screen against any criteria such as:

-

BISG testing

-

Tax guidelines

-

SBA requirements

-

Evolving regulations such as CFPB’s Dodd Frank Act 1071 reporting on loans to minorities and women-owned businesses

Uplinq can configure the product based on any, and all of a lender’s fitment requirements.

Business Reasons & Market Conditions

Uplinq believes in transparency in credit decisioning.

Today, when lenders reject a loan, the small business has no idea as to why. Underwriters have a difficult time explaining their decisions to business bankers, who find it difficult to explain the reasons to the end customer. To solve for that, Uplinq provides detailed positive and negative reasons on a scale of -100 to +100.

Today, when lenders reject a loan, the small business has no idea as to why. Underwriters have a difficult time explaining their decisions to business bankers, who find it difficult to explain the reasons to the end customer. To solve for that, Uplinq provides detailed positive and negative reasons on a scale of -100 to +100.